What Every Business Ought to Know About the Impact of Late Payments on Cash Flow

Let’s say you own a restaurant. What would happen if your customers said Great meal! I’ll pay the bill next time. You would feel strange, right? This is exactly what many small businesses face when clients delay payments for services or goods they’ve already enjoyed.

But why is this behavior so common—and even tolerated—when it comes to paying hardworking small business owners?

Unfortunately, this has become an industry standard. Over one in ten invoices issued by small and medium-sized businesses worldwide are paid beyond their agreed terms. This translates to a jaw-dropping trillion US dollars annually tied up in late payments.

In some cases, payments are so overdue that businesses have no choice but to write them off as bad debt. A big part of the issue is that many companies fail to realize the ripple effects of delayed payments. For small businesses, which lack the financial buffer to absorb these hits, the consequences can be crippling.

Impact of Late Payments on Cashflow

When businesses agree on a contract, they establish clear payment terms, specifying the number of days within which payment should be made after an invoice is issued.

However, when these deadlines are missed, the payment becomes late—assuming it’s received at all. For smaller businesses, such delays can severely disrupt operations, as they depend on a steady cash flow to function effectively.

Due to their size, SMEs are particularly susceptible to operational disruptions. Unlike larger firms, small enterprises often lack the resources to absorb financial shocks in the short term.

Cash flow remains a critical area of concern for many SMEs, as they typically operate with limited cash reserves. Any delay in income, such as late payments, can significantly affect their ability to maintain day-to-day operations.

When cash flow turns negative, small businesses are often forced to tap into reserves set aside for staff bonuses or other crucial expenses. In some cases, they may even need to reduce staff commissions—or worse, salaries—just to keep operations running.

This, in turn, can harm employee morale and productivity. Additionally, cash flow challenges often compel SMEs to scale back on future investments, putting long-term growth at risk simply to stay afloat.

Let’s visually explain this:

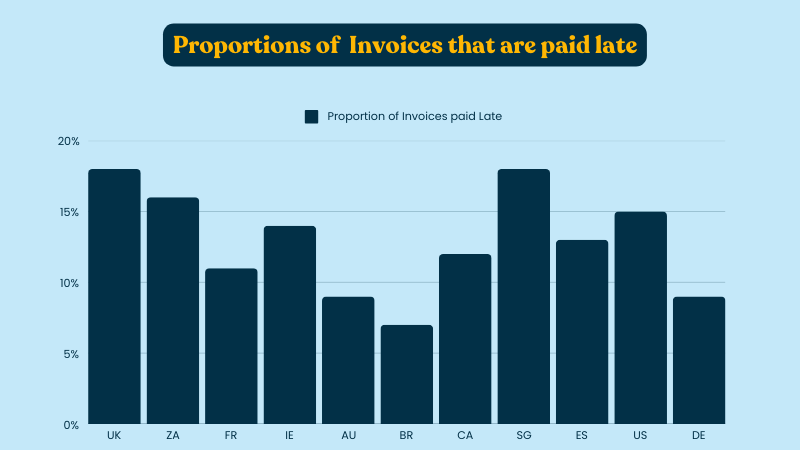

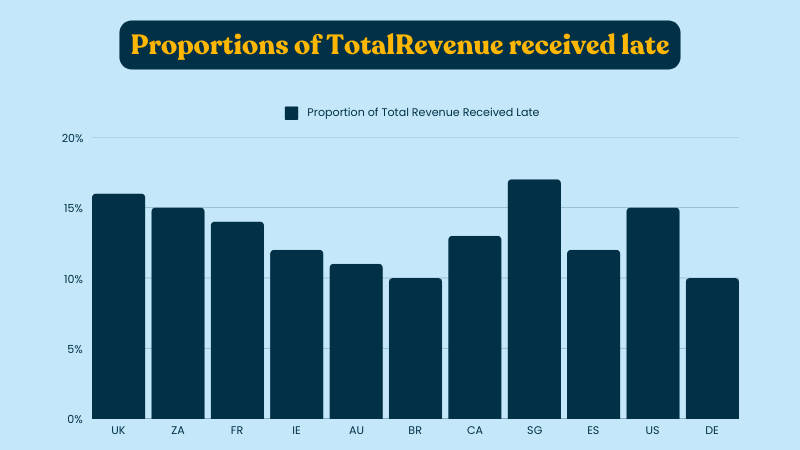

The chart above highlights the percentage of late payments for invoices across different countries. Singapore and the UK lead with the highest late payment proportions.

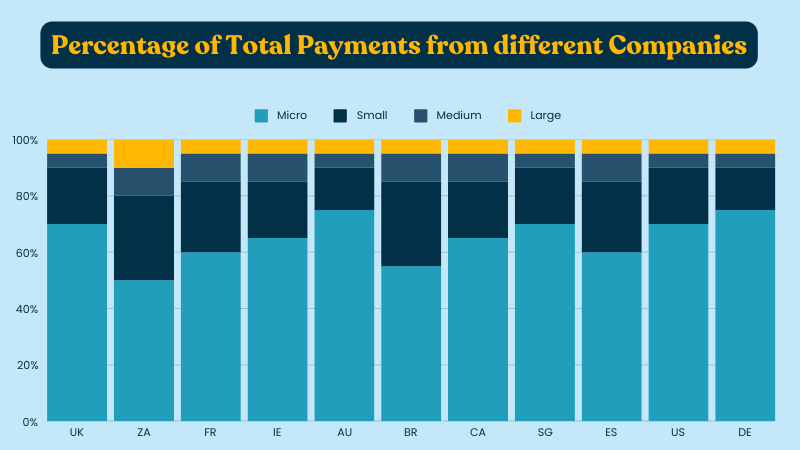

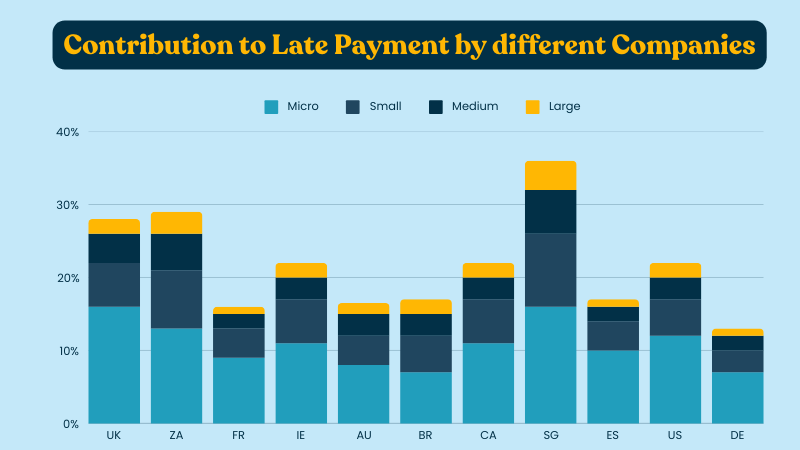

This chart breaks down payments made by micro, small, medium, and large companies. Larger companies dominate payment proportions, but smaller businesses often experience a more significant impact from payment delays.

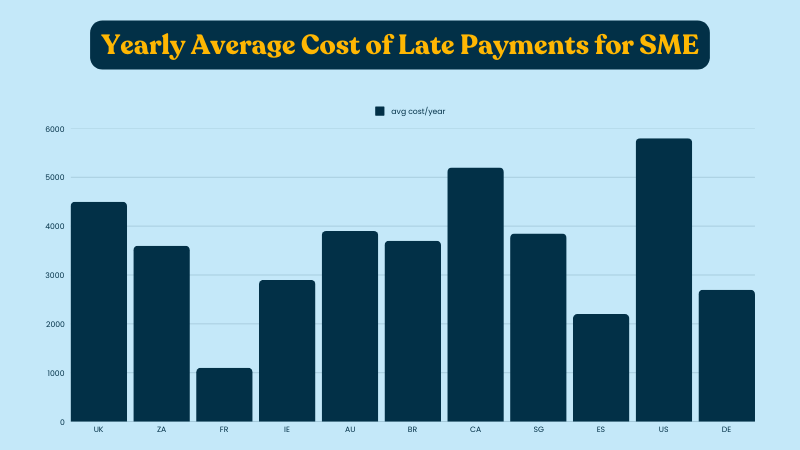

This graphic illustrates the financial burden late payments impose on SMEs in various countries. The US and Canada report the highest average yearly costs, while France shows comparatively lower costs.

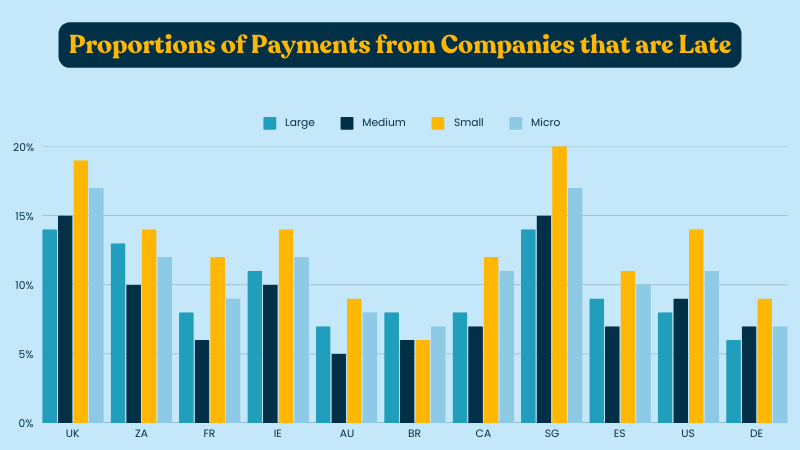

The above visual identifies how late payments are distributed among companies of different sizes. Micro and small businesses contribute to a significant portion of late payments in countries like Singapore and the UK.

This chart focuses on how each company size contributes to the overall late payments. In most countries, micro and small businesses are the primary culprits, though large companies also play a notable role in certain regions.

Finally, the above graph shows the percentage of total revenue received late across countries. Singapore and the UK again show the highest proportions, underlining the global challenge of late payments affecting business revenues.

As you can see these visuals collectively emphasize how late payments impact businesses differently based on geography and company size, with SMEs being disproportionately affected.

So, what’s the solution?

Invoicing software like Invo Bill offers a powerful solution to combat the challenges of late payments. By automating the invoicing process, sending timely reminders, and providing easy payment options, it helps businesses ensure faster and more consistent cash flow.

For SMEs, Invo Bill not only streamlines operations but also reduces the administrative burden, giving business owners more time to focus on growth while minimizing the risk of payment delays.