The Role of an Automated Accounts Receivable System in Improving Cash Flow

Have you ever tried calling your internet provider about an overcharge? You get put on hold, transferred three times, and finally, when someone picks up, they say, “I’ll escalate this and get back to you in 3-5 business days.”

This is how businesses feel when waiting for clients to pay invoices manually. It’s slow, inefficient, and frustrating, not to mention that it kills cash flow. And don’t just take our word for it. According to QuickBooks, U.S. small businesses are owed an average of $84,000 in unpaid invoices.

The solution to this problem is an automated accounts receivable system. It ensures invoices go out on time, reminders are sent automatically, and payments come in faster. So, let’s break down why and how an AR system improves cash flow.

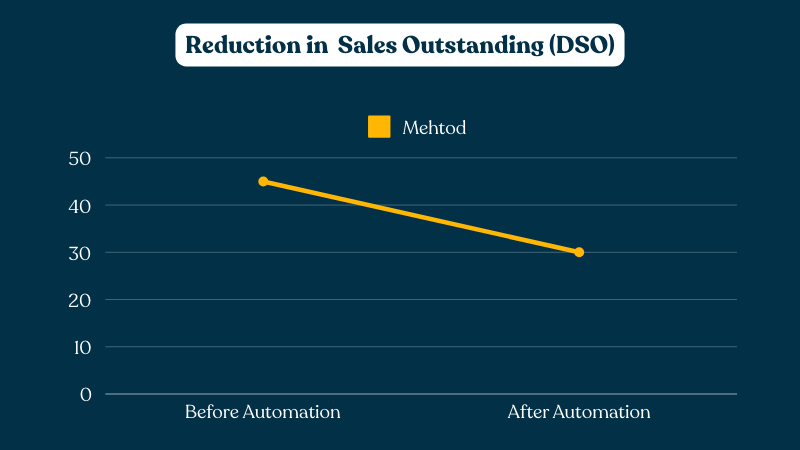

1. Reduction in Days Sales Outstanding

Days Sales Outstanding (DSO) is the average number of days it takes for a company to collect payment after issuing an invoice. It’s one of the biggest indicators of financial health. A higher DSO means slower cash flow, while a lower DSO means your money is coming in faster.

For many U.S. businesses, the average DSO is 45-60 days. That means nearly two months of waiting for money that’s already earned. On the other hand, companies that automate their AR processes see a 30-40% reduction in DSO, bringing it down to 25-35 days on average.

How Automation Fixes This?

Most business owners don’t realize that their DSO isn’t just about late-paying customers—it’s about inefficiencies in the invoicing process.

With automation, you can:

- Send invoices instantly

- Trigger automated reminders before and after due dates.

- Apply late fees automatically to incentivize faster payments.

2. Decrease in Invoice Processing Time

Most business owners assume invoicing is simple: Create the invoice → Send it → Get paid. However, manual invoicing is a productivity drain that eats your time, money, and cash flow.

Here’s how much time you’re losing:

- Drafting and approving an invoice: 20-30 minutes per invoice.

- Following up on unpaid invoices: 3-5 reminders per client.

- Manually tracking payments: 5-10 minutes per invoice.

When you add it up, businesses spend 5-7 days per month just managing invoices.

How Automation Speeds This Up?

By using an accounts receivable system, you eliminate these inefficiencies:

- Invoices are generated automatically based on contracts or work orders.

- Reminders are scheduled, so you don’t have to chase payments.

- The system tracks payments in real-time, so you always know what’s overdue.

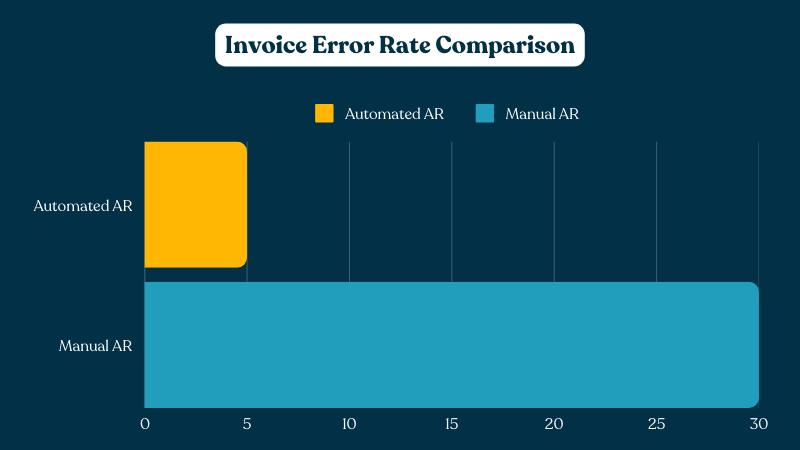

3. Reduction in Human Errors

Did you know that 40% of invoices contain errors? These include wrong amounts, duplicate charges, incorrect payment details, or missing information. And guess what? Each error delays payment by an average of 16 days.

Think about it, if a client sees an invoice that doesn’t match the agreed-upon price, what do they do? They don’t pay for it. Instead, they send an email, request corrections, and push payment another two weeks down the road.

How Automation Fixes This?

- Pre-filled invoice templates eliminate manual entry mistakes.

- Automated systems catch duplicate invoices before they’re sent.

- Real-time payment tracking reduces disputes and delays.

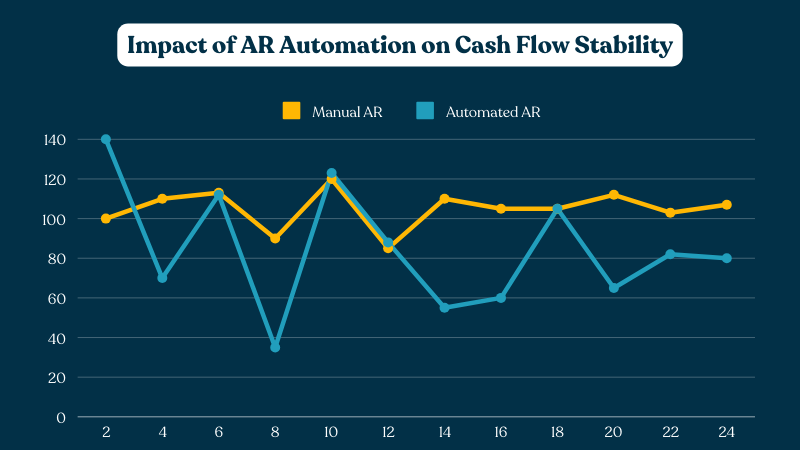

4. Impact of an Automated Accounts Receivable System on Cash Flow

Cash flow issues aren’t always caused by a lack of revenue. Sometimes, they’re caused by unpredictable payments. A business might be profitable, but if payments are delayed, they still struggle to:

- Pay rent, payroll, and operating costs.

- Reinvest in growth.

- Take on new projects.

In fact, according to U.S. Bank Study, 82% of small businesses fail due to cash flow problems.

How Automation Creates Predictable Cash Flow

- Real-time invoice tracking eliminates cash flow guessing.

- Reminders & payment links reduce late payments.

- Consistent follow-ups ensure fewer unpaid invoices.

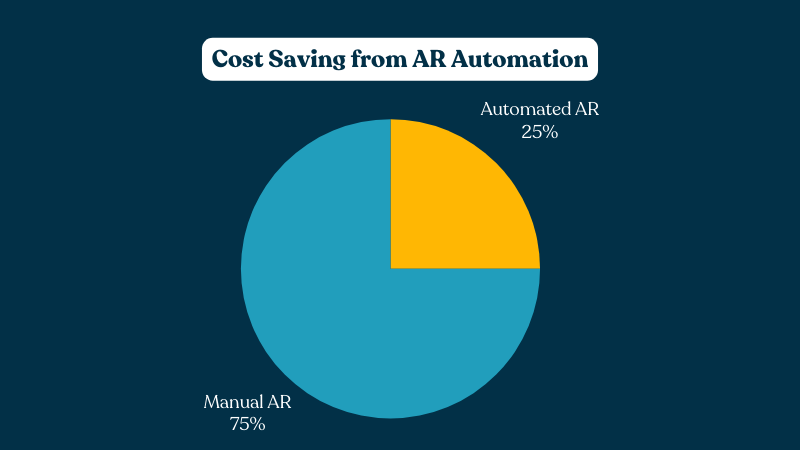

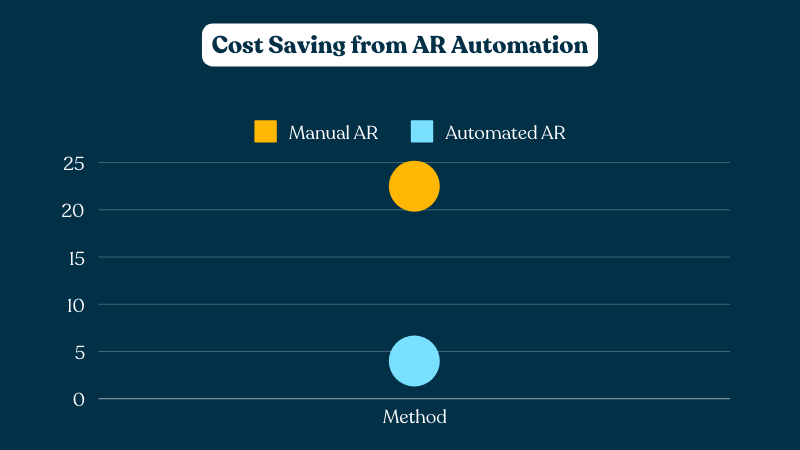

5. Cost Savings from Automating AR Processes

Most business owners don’t realize how much manual AR management is costing them. It’s not just about the frustration of chasing late payments; it’s about real financial losses in labor, penalties, and lost revenue.

Here’s where manual AR is bleeding your business dry:

If you’re manually tracking invoices, you need someone to send reminders, chase late payments, and update records. That’s dozens of extra hours per month, costing extra in payroll.

If your cash flow is tight because invoices aren’t paid on time, you might miss your bill payments—leading to penalties, interest fees, and strained vendor relationships. That’s why 22% of small businesses incur late fees due to cash flow gaps.

How AR Automation Cuts Costs?

By automating AR, businesses eliminate unnecessary expenses and maximize cash flow efficiency:

- Automation handles invoicing, tracking, and follow-ups, reducing the need for extra administrative staff.

- With predictable cash flow, you can pay vendors, suppliers, and employees on time.

- Automated reminders increase timely payments and reduce the risk of write-offs on unpaid invoices.

How InvoBill Helps Businesses Automate Accounts Receivable?

You send invoices, wait for payments, manually track outstanding amounts, follow up when clients forget to pay, and sometimes even chase them for weeks. When the payment finally comes in, you’re already short on cash for payroll, suppliers, or new investments.

This broken cycle leads to unpredictable cash flow, wasted resources, and constant frustration. But it doesn’t have to be this way.

We built InvoBill to eliminate the manual headache of managing AR. Instead of spending hours tracking invoices and chasing payments, you can automate the entire process—saving time, improving cash flow, and ensuring you get paid on time.

Here’s how InvoBill transforms your AR process:

- Know exactly where your money is at any given moment. With InvoBill, you don’t need to guess which invoices are still pending or dig through emails to check payment statuses.

- InvoBill sends smart, automated reminders that nudge customers to pay without making you the bad guy.

- If you’re already using QuickBooks, InvoBill plugs right in, eliminating the need for double entry.

- One of the biggest reasons clients delay payments is limited payment options. InvoBill eliminates this friction by offering multiple payment options.

We have so much more to unpack, and if you want to know more about InvoBill, join our waiting list; we are about to go live.